Dec 10, 2024

Dripos Will Become a Unicorn

My first Substack post was my thesis behind Dripos, a vertical SaaS for coffee shops. Last week I had the chance to speak with the founder & CEO, Jack Pawlik!

To gain a broader understanding of Dripos, I'd recommend starting with my earlier post here. In summary, Dripos raised an $11 million Series A this spring to expand their full stack software suite, which currently includes online ordering, team management, customer loyalty, payroll, and accounting software for coffee shops. They generate revenue through SaaS fees for providing the software stack and take-rates on in-store POS and online payments.

My initial excitement around Dripos stemmed from how well it aligned with a thesis I've been tracking – the cost of building software has been asymptotically approaching zero, making distribution king. Decreasing marginal costs for building software are driven in part by advancements in LLM powered dev tools but is a broader trend we've seen over the last two decades with cloud providers and internet infra companies, such AWS and Stripe, enabling software to be developed and provided cheaper than ever before. There's a future that is quickly approaching where software development is effectively free, and those with a distribution advantage will dominate. This is why I believe Dripos, by being one of the only vertical SaaS companies for the ~$350 billion U.S. coffee industry, has a massive competitive advantage.

But over the last few months, I've had several conversations within the early-stage technology community about Dripos, and I've found two broad "consensus" views that have led many to overlook Dripos as a future unicorn –

- Selling into lower-margin small and medium-sized businesses (SMBs) is challenging

- The market size is too small to support a venture-backable outcome

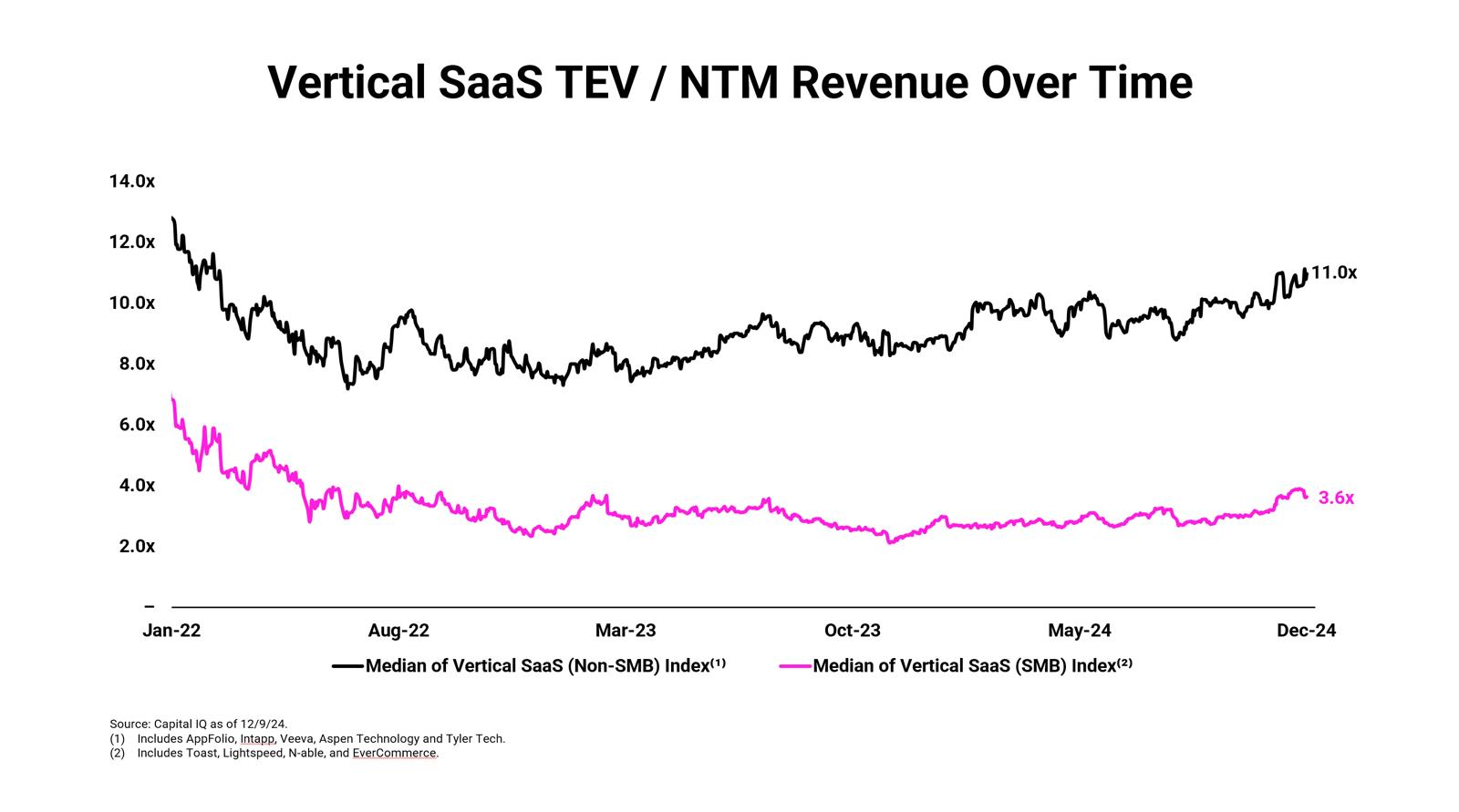

I agree with the first point – higher churn and lower customer retention are to be expected when selling to customers with tight pockets. While I believe Dripos' software saves coffee shops more money than it costs, there's a structural valuation difference in public markets, where vertical SaaS companies targeting SMBs currently trade at a 7.4x discount on a TEV/NTM revenue basis compared to their non-SMB peers.

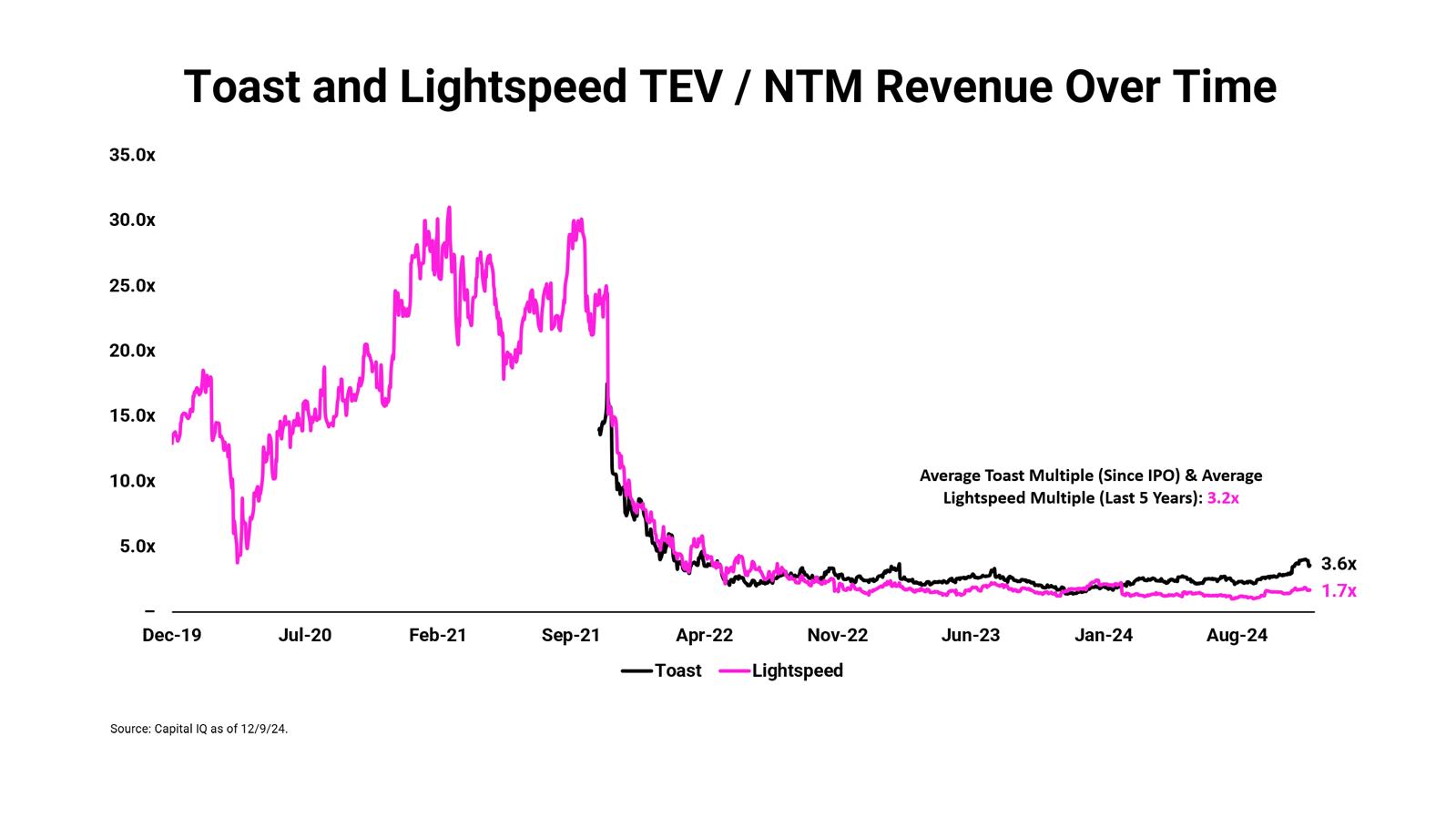

Within the vertical SaaS (SMB) index, however, Toast and Lightspeed are Dripos closest publicly traded comparables (and competitors). Looking at their revenue multiples over time (note: Toast IPO'd in September 2021), it's clear that in the post 2021 era, multiples for this peer set have settled around 1.5x – 4x TEV/NTM revenue.

While the average Toast multiple (since IPO) and average Lightspeed multiple (last 5 years) is 3.2x TEV / NTM revenue, Dripos has far more favorable growth dynamics than its peer set. Dripos reportedly grew by over 400% leading into their Series A earlier this year, while Toast and Lightspeed only grew at 23% and 18% over the same period, respectively.

A recent report from RedPoint Ventures found that the average premium to public comparables for private early-stage software companies is between 50% to 450%, largely driven by the accelerated growth rates of early-stage companies.

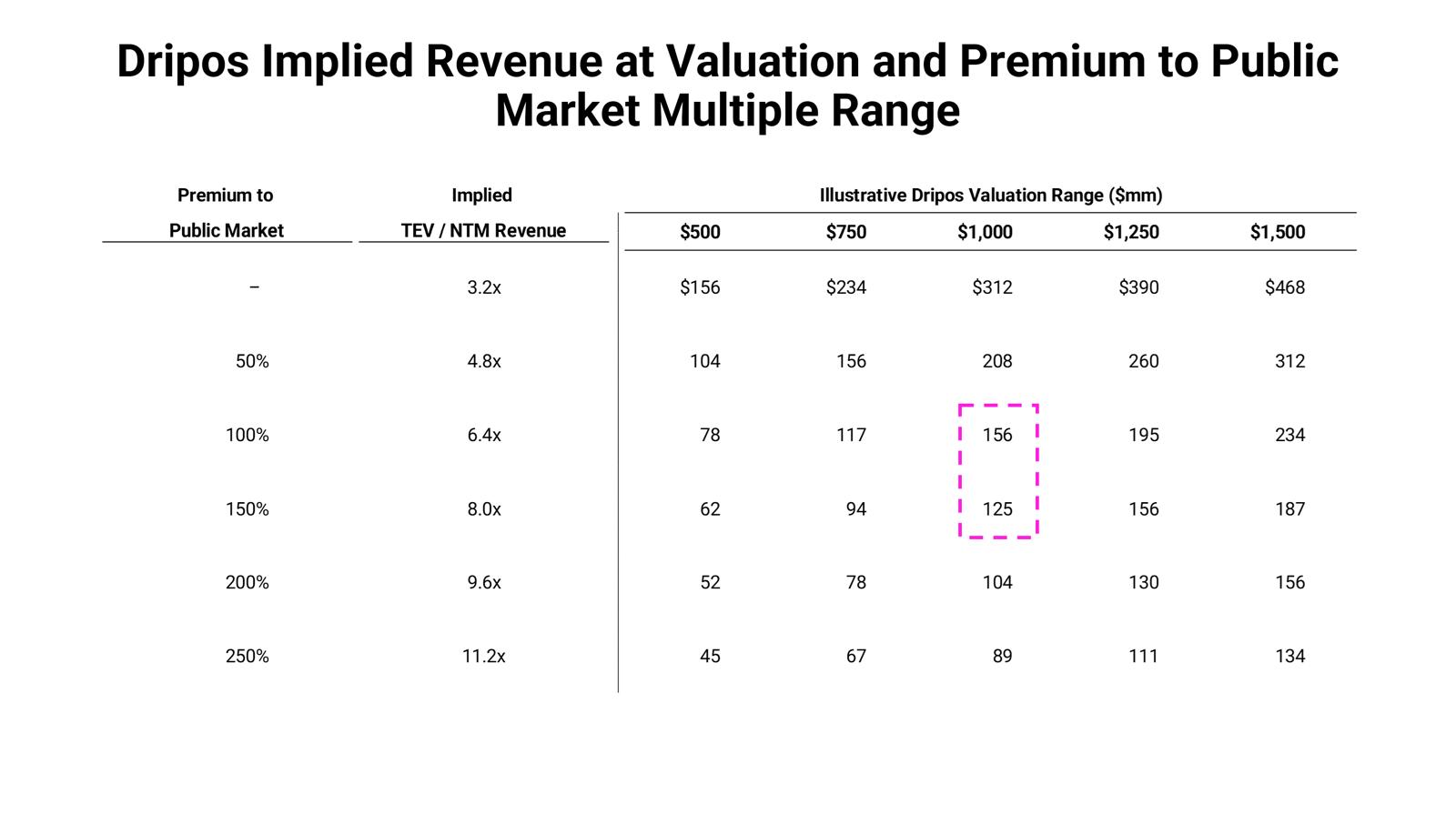

Below I've back solved for the implied Dripos revenue at a valuation and premium to public market multiple range.

Assuming a premium to public market multiple of 100 – 150%, for Dripos to become a unicorn, they must achieve revenue in the ballpark of $125 million - $156 million. This is considerably higher than vertical SaaS peers that sell to non-SMB businesses which, at a 11.0x TEV/NTM revenue multiple, would require only $90 million of revenue to be considered a unicorn.

But I fundamentally disagree with the view that the market Dripos operates in is not large enough to support this revenue target. It's easy to fixate on the $110 billion of total annual consumer payments at U.S. coffee shops and miss the larger opportunity – the $343 billion U.S. coffee shop industry. Dripos is not only looking to capture payments revenue through customer POS but instead leverages a full stack software solution to provide fintech offerings throughout the entire coffee ecosystem, from coffee shops to its suppliers and eventually even producers.

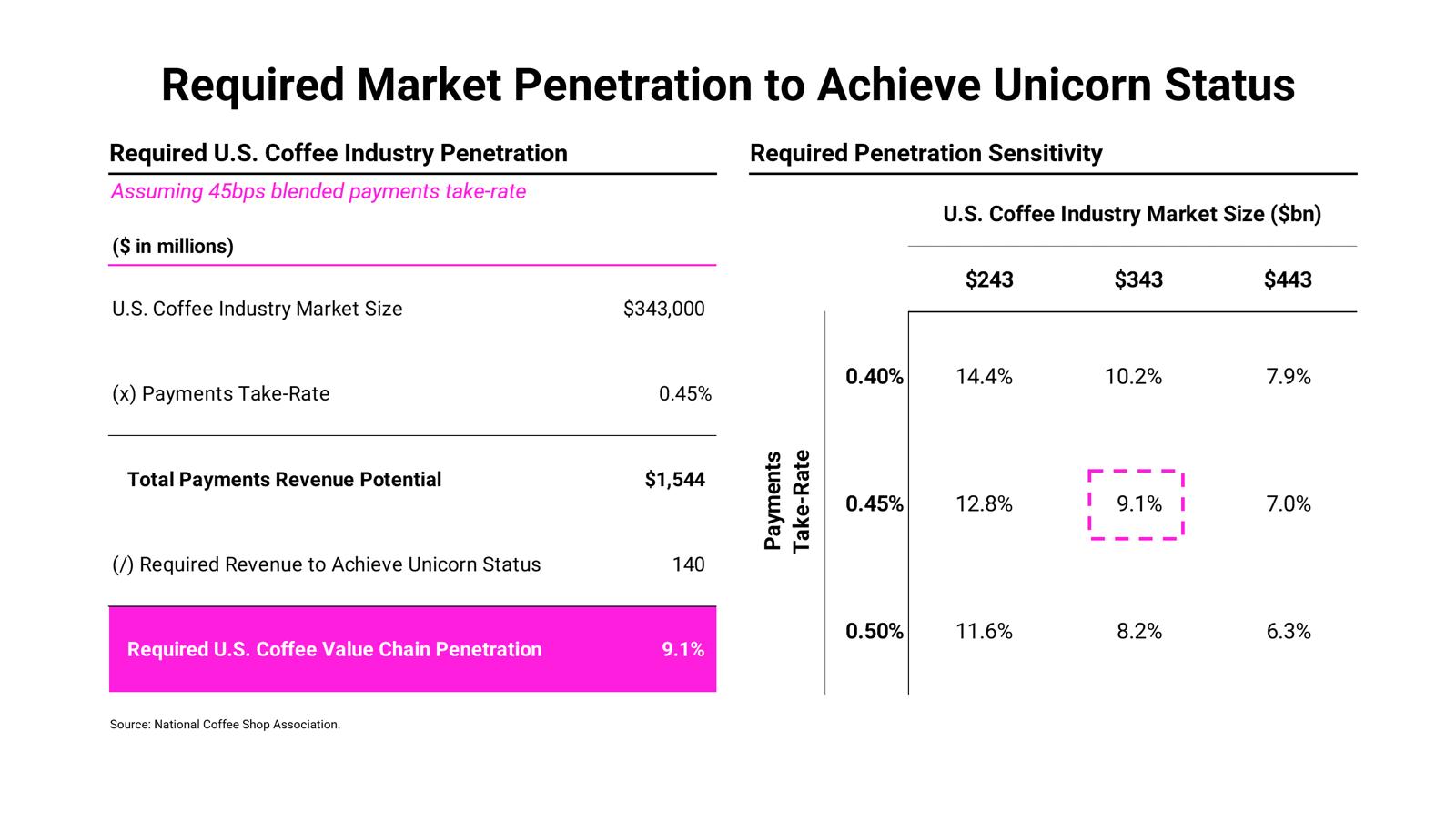

Currently, Dripos processes payments through Stripe, and charges an additional 25 bps plus a fixed fee of 25 cents when transferring funds. I've assumed a blended take-rate of 45 bps and have sensitized the impact on implied penetration below.

In order to achieve $140 million in revenue (the midpoint of $125 and $156 million) to be considered a unicorn, Dripos must facilitate ~9% of all payments in the U.S. coffee industry, excluding recurring SaaS revenues from providing its software solution. More importantly, even assuming a $100 billion haircut to the size of the U.S. coffee shop industry and a blended take-rate of only 40 bps, Dripos still needs less than 15% market share to become a unicorn.

Achieving these levels of market penetration when you are one of the only vertical SaaS providers is a feasible target, especially when other vertical SaaS companies such as Mindbody (full stack software suite for gyms and yoga studios) have achieved over 50% market share with in its respective market.

When I spoke to Jack last week, I was amazed with the vision he had for Dripos. It's more than ripping out Toast's POS in coffee shops – he's building software to connect the entire coffee ecosystem and embedding fintech offerings along the way.

It's a lofty mission but I have full conviction in Jack and the rest of the Dripos team on being able to execute it. On top of being an extremely humble and down-to-earth person, it was clear that Jack loves helping coffee shop owners, which I believe has enabled much of their success to date. Watch him speak about Dripos (then known as Drip) in 2019 as a senior at the University of Wisconsin:

To have this level of poise as a senior in college is remarkable and it was abundantly clear to me that he's just as humble now, as the CEO of 25+ person company, as he was back then!

This is how I see Dripos becoming a unicorn and why I'm so so excited about what the future holds for this team!

Thanks for making it all the way to the end – if you have any thoughts, questions, or feedback, I'd love to hear them!