Oct 11, 2024

My Thesis Behind Dripos

Vertical SaaS is having its moment and Dripos is leading the charge in the coffee shop industry.

In a market where horizontal POS players struggle to differentiate, Dripos has taken a unique approach – focusing exclusively on highly customized orders for coffee shops and other quick service restaurants. Just as Toast carved out its market share from Square by providing a specialized solution for restaurants, Dripos is well-positioned to replicate this success for food service industries that deal with highly customized orders, starting with coffee shops. Dripos has the potential to become the go-to vertical platform for coffee shops, pizzerias, juice bars and beyond.

What is Dripos? An all-in-one solution that includes POS, team management, payroll, customer loyalty and accounting software for coffee shops. Founded in 2019 by Jack Pawlik (a former Barista) and Avery Durrant, Dripos emerged from the founders' recognition of the industry's struggle with fragmented software systems. Their vision has resonated strongly with coffee shop owners, evidenced by an impressive 400% annual growth in their user base, expansion across 48 states, and processing hundreds of millions in GTV annually. Backed by Y Combinator and Base10 Partners, Dripos has secured $17mm in total funding, including their recent Series A round in April 2024.

This article will be a deep-dive into Dripos and why I have conviction in the business:

- The Coffee Shop Owner Dilemma

- The Rise of Verticalization in SaaS

- Dripos Business Model & Market Opportunity

- The Founding Team

- Why I Believe in Dripos (i.e. my investment thesis!)

1. The Coffee Shop Owner Dilemma

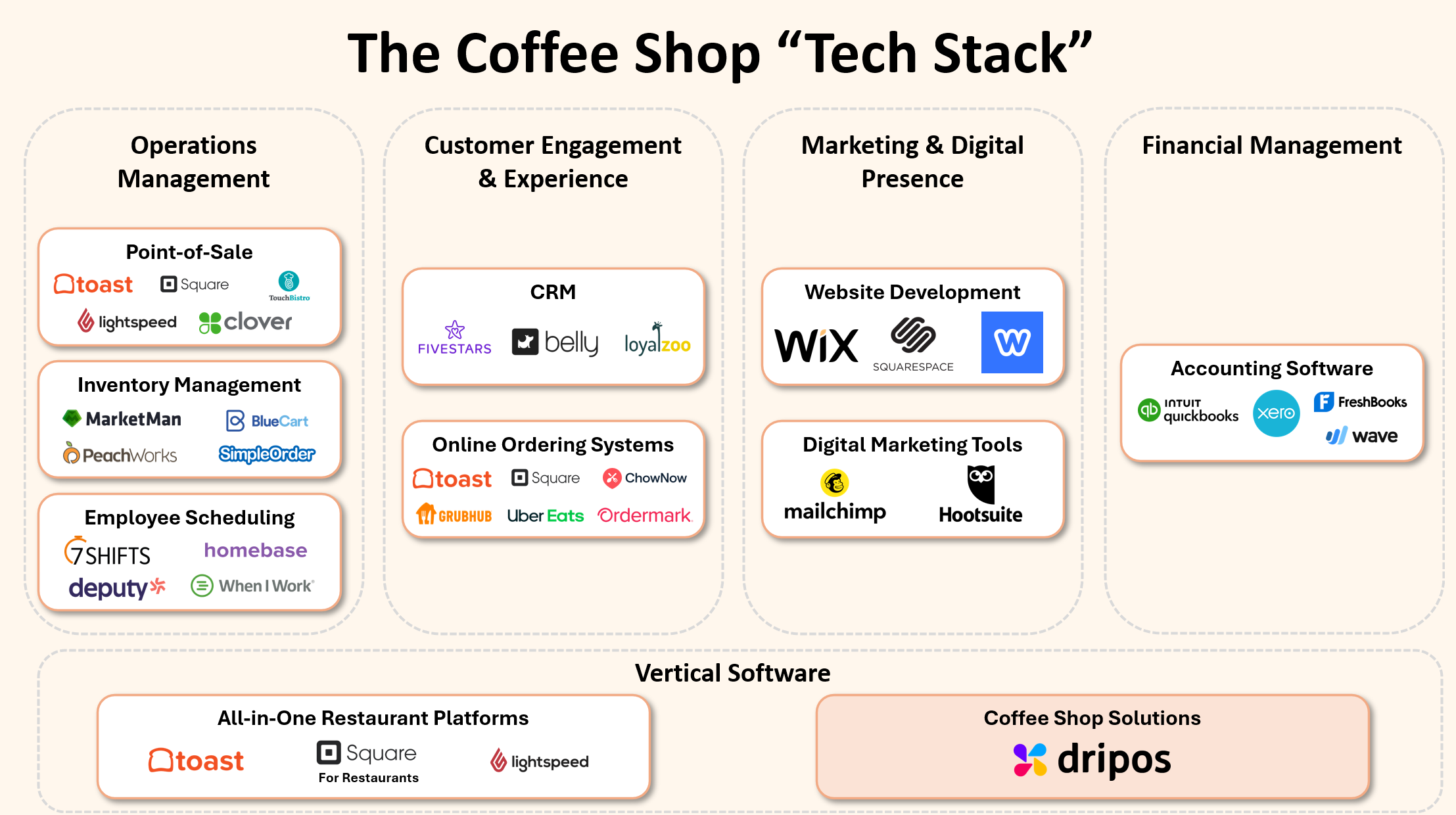

Dripos addresses a critical challenge in the coffee shop industry: the fragmentation of software solutions in a typical coffee shop's "tech stack". A hypothetical coffee owner can be faced with the below options to run their business:

As you can tell, there's a lot of software solutions to choose from! From POS systems to employee management and accounting software, coffee shop owners must navigate a multitude of tools to run their business. As Jack Pawlik, Co-founder & Co-CEO of Dripos, puts it:

"Coffee shop owners have long grappled with the challenge of juggling 5-10 software solutions to meet their operational needs"

However, using a patchwork of software solutions is not an ideal "tech stack" for coffee shops.

The physical juggling act of switching between multiple platforms combined with the technical integration complexities can lead to significant loss in business productivity. And since each software solution must be acquired independently, using a patchwork of solutions can become prohibitively expensive for coffee shops that already operate on tight margins.

Vertical solutions remain scarce in this space, while Dripos' closest competitors are catered towards a different type of product.

While broader all-in-one restaurant platforms like Toast and Square exist, they often fall short of meeting the specific needs of coffee shops. Toast, Dripos' closest competitor, offers a fundamentally different product aimed at general restaurant operations rather than the nuanced demands of coffee shops. Consider the following scenarios:

Allie orders at a Wendy's drive-through: "I'll take a 10-piece chicken nugget with ketchup on the side." Simple and straightforward. Now, contrast that with Allie's order at a coffee shop: "I'd like a grande iced, decaf, sugar-free vanilla latte with oat milk. Make it extra hot with three pumps of caramel syrup, one pump of sugar-free hazelnut, and a sprinkle of cinnamon on top."

The complexity of the second order highlights the gap that Toast's platform struggles to address. It's built for un-customized orders, typical of fast-food restaurants. In contrast, Dripos' software is purpose-built for the intricate customizations that are standard in coffee shop orders.

2. The Rise of Verticalization in SaaS

The trend towards verticalization is not unique to the coffee shop industry. In fact, it's becoming increasingly prevalent across various sectors as companies, like Dripos, begin to leverage advancements in foundational technology infrastructure to create a differentiated offering.

I believe there are fundamentally two reasons driving this change – advancements in foundational technology and the intensity of competition at the point of sale.

Advancements in Foundational Technology

A fitting analogy can be drawn from the late 1990s, a time before cloud computing when startups needed to make significant investments in physical data centers. The emergence of cloud computing, led by players like AWS, fundamentally shifted this dynamic. Startups can now "rent" computing power on-demand from cloud providers.

Today, we see a similar shift as startups benefit from access to a robust and mature technology infrastructure. Through APIs, companies can easily integrate critical functions like payment processing, marketing automation, and even generative AI capabilities. For example, Stripe's API has simplified payment integration while Twilio provides communication functionalities with minimal setup.

Therefore, one of the key reasons a software provider like Dripos can exist and thrive is its ability to leverage pre-built API integrations for POS and inventory management systems, allowing it to focus on developing features that address the specific complexities of coffee shop operations.

Competition at the Point of Sale

As the foundational technology layer continues to advance, the POS market has become increasingly saturated and competitive. Established players like Square have capitalized on their first-mover advantage, offering broad, horizontal solutions that cater to a wide range of businesses. However, as the market matures, these generalist offerings often struggle to meet the nuanced needs of specific industries.

The advantages of going vertical are threefold – additional revenue from new product offerings, strengthening the relationship with the end consumer, and winning at the POS level.

3. Dripos Business Model & Market Opportunity

Dripos generates revenue through payment processing at the POS and subscription fees for providing a comprehensive technology stack.

Dripos charges a flat rate of 2.9% + 5 cents per transaction for its hardware POS. Dripos software subscription starts at $149/month per location, to access their core suite of tools including ordering systems, marketing tools, team management and core business operations software.

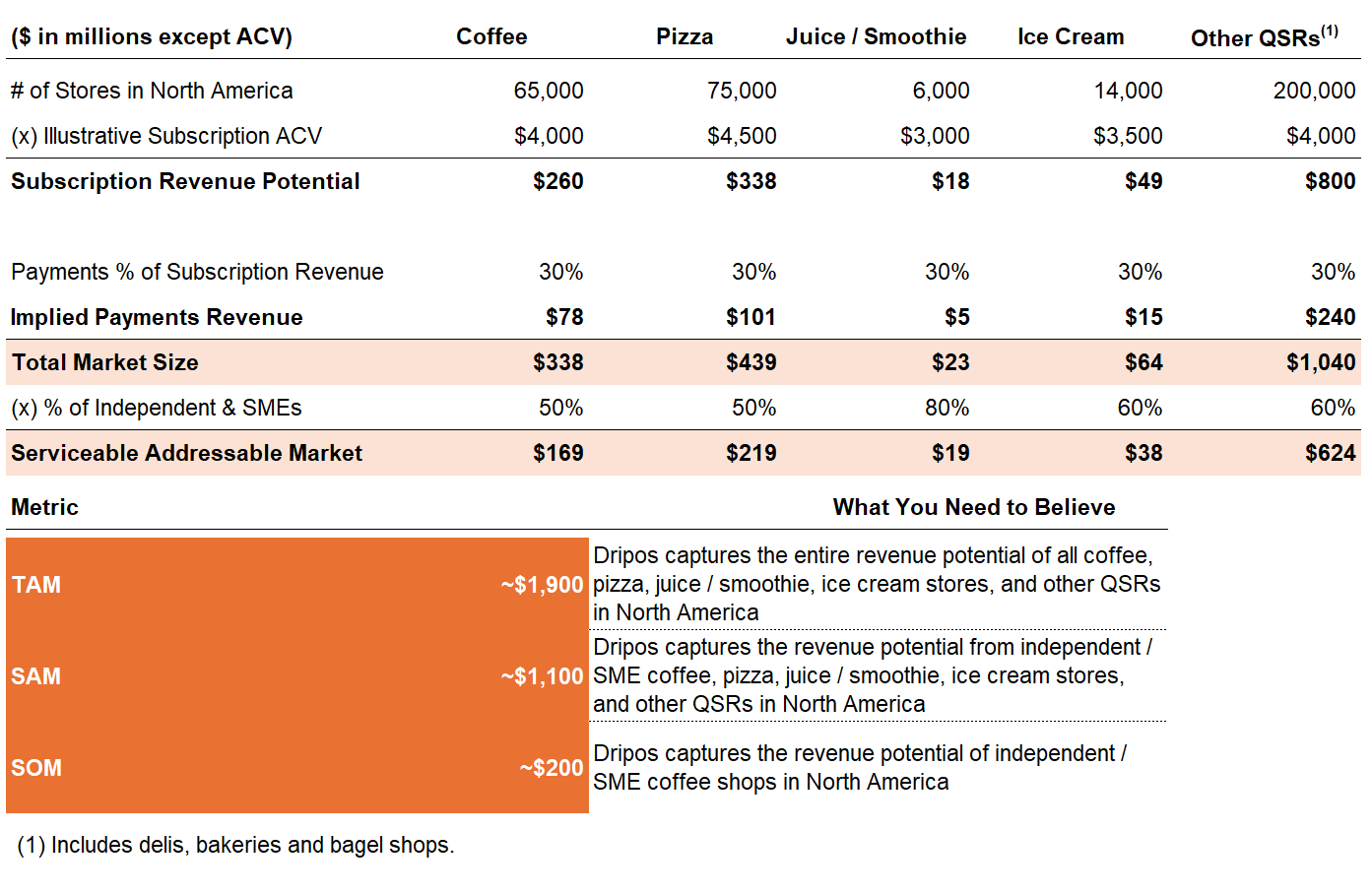

While Dripos' value proposition lies in its ability to handle highly customized and complex orders, this is not a unique challenge for coffee shops.

Pizzerias, juice and smoothie bars, ice cream and frozen yogurt shops, along with other quick service restaurants (QSRs) like delis, bakeries, and bagel shops, face similar challenges to coffee shops, dealing with highly customized orders at roughly comparable ticket prices.

With the TAM for Dripos being roughly six times larger than the market size of the coffee shop vertical alone, it's crucial for the company to demonstrate its ability to develop software that meets the needs of adjacent markets with the same level of quality.

4. The Founding Team

Jack Pawlik, Dripos' co-founder, brings hands-on experience from both startup and industry perspectives. He previously co-founded Leapline, a YC-backed startup that enabled users to skip lines at events and venues. To deeply understand Dripos' users, Jack spent his first few months at Dripos working for free as a barista at Café Social in Madison, Wisconsin, Dripos' very first customer.

Avery Durrant, Dripos' technical co-founder, brings a wealth of technical expertise from his time as CTO at Cork Drinks and as a software engineer at Deltek. As Dripos' founding engineer, Avery developed the first iterations of the product, implementing changes rapidly based on feedback Jack gathered from coffee shop environments.

The founding team is a tight-knit group from the University of Wisconsin at Madison, with a complementary blend of skills—Jack driving business strategy and customer insights, while Avery leads technical execution.

5. Why I Believe in Dripos (i.e. My Investment Thesis!)

My conviction in Dripos is driven by two key factors: strong traction within the coffee shop segment and a substantial market opportunity ahead.

Dripos' laser focus on delivering an exceptional experience for coffee shops has translated directly into impressive business outcomes. They've achieved over 400% year-over-year growth since inception, largely fueled by organic, word-of-mouth sales – a testament to the value they bring to their customers and the strength of their product-market fit.

Moreover, as they solidify their foothold in coffee shops, I see significant upside potential in their expansion into adjacent verticals, starting with pizzerias and quickly moving into juice and smoothie bars, ice cream and frozen yogurt shops, and other QSRs.

The primary risk lies in determining whether Dripos can replicate its product-market fit at the level of customization required across different industries or if its success in coffee shops was an isolated incident. To have full conviction in Dripos, I need to be confident that coffee shops are not just selecting Dripos for its specialized focus, but also because its customizations provide significant advantages over broader solutions like Toast.

Thanks for making it all the way to the end! If you have any thoughts, questions, or feedback, I'd love to hear them – your input is always valuable.