Oct 30, 2024

My Thesis Behind Rogo

Rogo is building Wall Street's first "AI Analyst" to streamline current analyst workflows.

For many people, myself included, finance is seen as an exciting career where you can advise companies on high-stakes transactions and tackle some of the most pressing and current business problems of our time! As a second-year investment banking analyst – I would wholeheartedly agree with this view. In just over a year, I've worked on several marquee transactions including the $8bn restructuring of an Apollo portfolio company, the $20bn sale and subsequent activism defense of Frontier Communications and advised the NFL on developing a policy to allow private equity investments in teams.

Even before I started my investment banking role, I knew the inherent value of being a "fly on the wall" during high-level business meetings. But what I've realized is that while junior bankers may get some exposure to these situations, far and away their most important responsibility is producing work product. The powerpoint decks and excel models that are created by analysts and iterated on by the team are crucial for articulating the advice that senior bankers provide to their clients.

Generative AI models have the potential to revolutionize analyst workflows. Rogo closed its $18.5 million Series A round earlier this month, in a funding round led by Keith Rabois at Khosla Ventures, and are focused on building Wall Street's first "AI Analyst". Here is why I have conviction in the business:

- What is Rogo?

- The Team Behind Rogo

- Why is Now Rogo's Time to Shine?

- How is Rogo Differentiated (i.e. competitive MOAT)?

- Why I Believe in Rogo (my investment thesis!)

1. What Is Rogo?

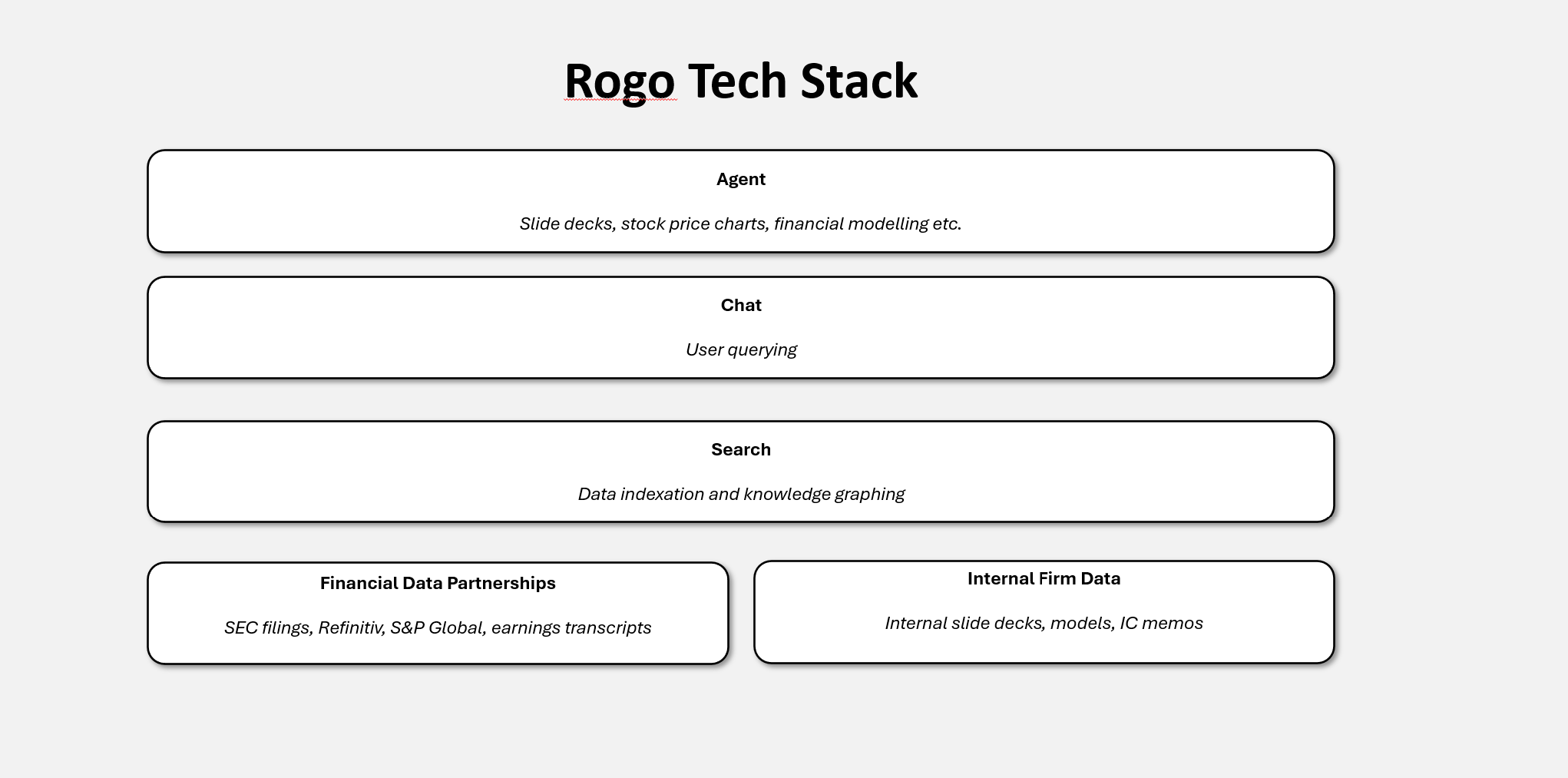

Rogo is building Wall Street's first "AI analyst" using a robust four-layer technology stack. I've tried my best to visually lay this out below:

At its core, the Data layer forms the backbone of Rogo's tech stack. The platform is currently powered through two main data sources. The first is proprietary data, acquired through strategic partnerships with financial data providers like S&P Global and Refinitiv. The second source is internal firm data, which Rogo accesses in a highly secure and compliant manner, enabling it to utilize precedent slide decks, excel models, and IC memos within the organization.

The Search layer is designed to organize and make sense of the vast corpus of data it collects. At this layer, Rogo processes and indexes both structured and unstructured data from proprietary financial sources and internal firm databases. This data is then woven into a knowledge graph, where each company acts as a node and is enriched with interconnected data points, such as a product description, financial metrics, and stock price performance.

The Chat layer provides a natural, conversational interface that allows users to interact seamlessly with the extensive knowledge graph. This layer functions like an intelligent assistant, enabling professionals to ask questions in everyday language and receive instant, contextually relevant responses.

The agent layer is the pinnacle of Rogo's tech stack where data insights translate into actionable outputs. This layer autonomously generates polished deliverables such as pitch decks, financial models, and investment memos by harnessing data from the knowledge graph and insights gathered through the chat layer.

Let's take an actual example – a common task in investment banking is to benchmark research analysts' projections for all the key line items for the company of interest.

The process begins with the analyst accessing a database, such as Refinitiv, to download all recent broker reports for a specific company. Next, they must use excel to manually input data for each line item – such as revenue, EBITDA, and net income. This data entry process is repeated for each research analyst covering the company, with most companies often having 15-20+.

As a current investment banking analyst who has gone through this process countless times, I can personally attest that it often can consume the better part of a day. Now, let's explore how Rogo's capabilities can streamline this workflow.

Instead of manually downloading broker reports and extracting key metrics line by line, Rogo's full stack solution can handle these steps automatically. This entire workflow – from data retrieval to chart creation – is executed within minutes. Not only is this valuable time saved, but Rogo also minimizes errors inherent in manual data handling.

2. The Team Behind Rogo

Rogo is Wall Street's next "AI analyst" built by former Wall Street analysts.

Gabriel Stengel (CEO), John Willett (COO), and Tumas Rackaitis (CTO) co-founded Rogo in 2022, driven by their shared vision to transform financial workflows through AI.

Gabriel Stengel holds a bachelor's degree in computer science from Princeton University. During his time in college, he founded a company focused on automating the creation of pitch decks for investment banks, an early version of what eventually became Rogo. Most recently, he worked at Lazard in a cross-functional role, contributing to both the investment banking team and the IT/data team.

John Willett holds a dual degree in Economics and Computer Science from Princeton University. Before launching Rogo in 2022, he worked as an Investment Banking Analyst at Barclays and J.P. Morgan.

Tumas Rackaitis holds a degree in Computer Science from Oberlin College. Before co-founding Rogo in 2021, Tumas worked as a technology specialist at Gilder Gagnon Howe & Co., where he gained valuable insights into the financial sector.

3. Why Is Now Rogo's Time to Shine?

There are two reasons why I believe now is Rogo's time to shine – advancements in the foundational model layer and recent pressure on CTOs to develop their AI strategy.

Today, Rogo's product leverages the foundational infrastructure of LLMs, transforming how financial data is processed and interpreted. By fine-tuning these LLMs for financial institutions, Rogo enables its platform to deliver instant answers to complex, vertical-specific workflows.

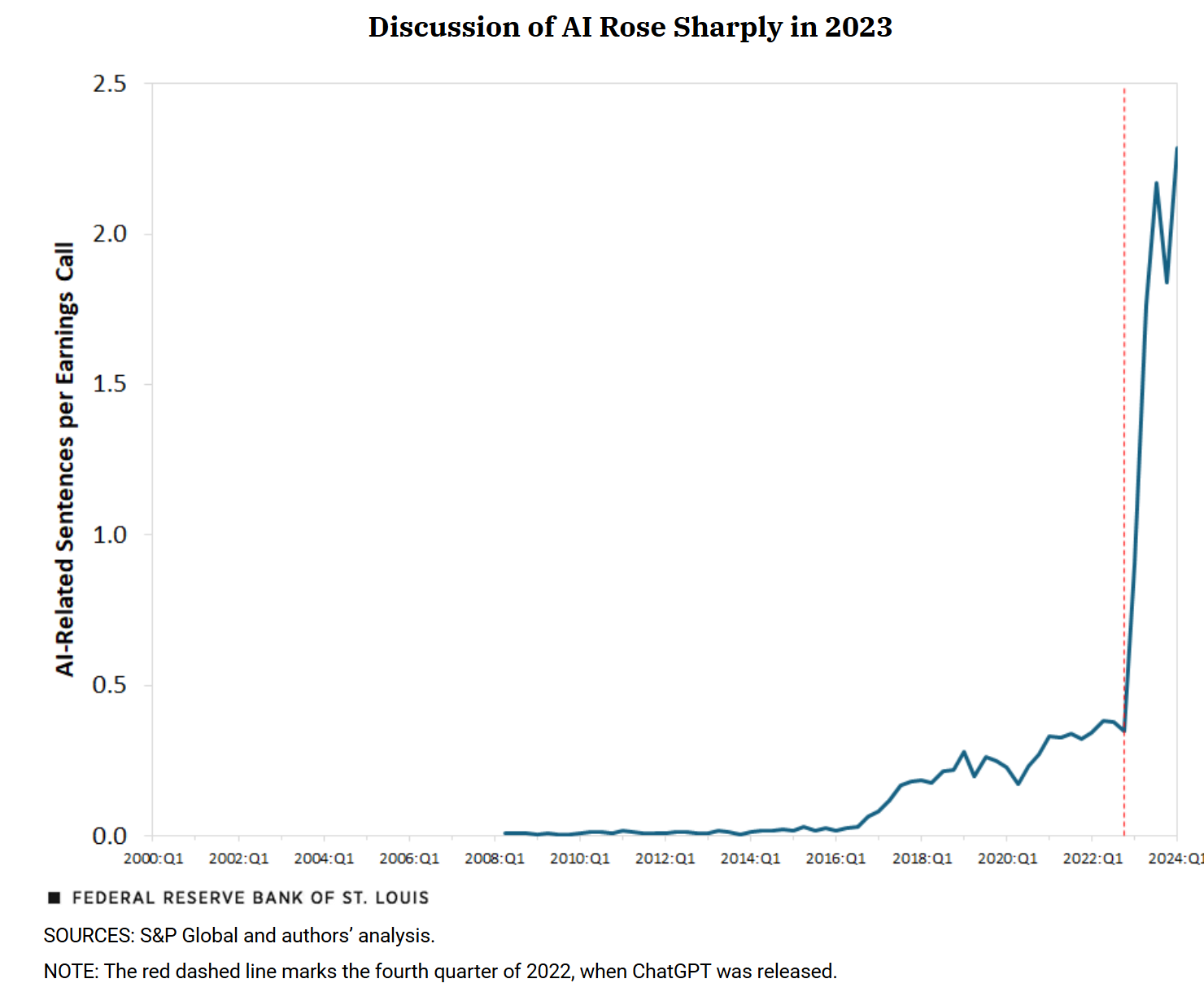

As foundational models help enable the technological infrastructure necessary for Rogo's product, CTOs are under increasing pressure to develop their AI strategy. Since the release of ChatGPT in November of 2022, the number of AI-related sentences in earnings transcripts have spiked five-fold.

I believe most CTOs at financial institutions will focus on partnering with a third-party company such as Rogo. This approach presents an attractive solution by addressing many barriers associated with developing an AI strategy. Third-party providers typically adhere to the highest industry security standards, enabling seamless and compliant data integration.

4. How Is Rogo Differentiated (i.e. Competitive MOAT)?

Large foundational models, such as ChatGPT, may struggle to enter this market due to the scaffolding that Rogo provides on top of base LLMs to provide a usable product.

There are three barriers to entry that prevent foundational models from entering Rogo's markets – data partnerships that Rogo has with financial data providers, best-in-class security protocols for enterprise customers, and stronger knowledge of what financial institutions are looking for in their product.

Even if LLMs are willing to invest the time and resources needed to form these data partnerships, they will need to significantly invest in the compliance and security infrastructure needed to be a technology provider to financial institutions.

Rogo offers a product that complies with both GDPR and FINRA regulations, ensuring it meets the highest security standards in the industry. Built on a modern zero-trust security model, Rogo incorporates principles such as least privilege access, just-in-time access management, and robust authentication procedures.

Lastly, LLMs lack the deep understanding of the specific enterprise use case that Rogo is looking to address. The founders of Rogo bring firsthand experience from their experience in investment banking, having directly engaged with the challenges of the analyst tech stack.

While there are a handful of other AI startups in the financial institution space, none of them offer a similar product to Rogo. Rogo's core offer includes its PowerPoint agent, which addresses a critical aspect of the investment banking workflow. To my knowledge, no competitors, including Hebbia, offer a similar solution.

5. My Thesis Behind Rogo (My Investment Thesis!)

As a current investment banking analyst, I've witnessed firsthand the challenges of producing critical work product with an outdated technology stack. While the rise of LLMs presents an opportunity to revolutionize analyst workflows, Rogo stands out as the first "AI Analyst" specifically designed for the unique demands of financial institutions.

According to McKinsey, global technology spending by financial institutions reached $650 billion in 2023 and is projected to grow at an annual rate of 9%. Assuming Rogo raised its Series A round at an approximate $100 million valuation and eventually captures just 0.5% of this market, this can be a >30x opportunity for current investors. Rogo has already gained significant traction, with 25 financial institutions currently using its product.

The primary existential risk for Rogo lies in the mishandling of sensitive firm data. While Rogo offers a highly secure solution, a single security breach could jeopardize the entire company. To gain full conviction in this business, I would ideally want to speak with financial institutions directly to understand how they perceive potential data risk when using a third-party vendor like Rogo.

Thanks for making it all the way to the end! If you have any thoughts, questions, or feedback, I'd love to hear them – your input is always valuable.